Apple’s tightening grip is just rigor mortis

The wall will fall and Web3 will eventually bloom

The three key changes to Apple’s app review guidelines — 3.1.1, 3.1.3(g) and 1.1.7 — are all about tightening control over an asset that from a teleologic point of view is slowly slipping away.

There are plenty of good explanations of the nuts and bolts, so I’m not going to repeat them. For the record, I liked Foss Patents’ take.

Leaving aside the change for “current events” — technically a restriction in freedom of speech, but one Google has previously implemented — it’s clear Apple continues to reduce the freedom of developers to engineer iOS apps to give themselves any financial advantage to the relative negation of Apple, no matter how detrimental to users and the App Store experience.

For, specifically, with both the social medium advertising and NFT changes, Apple is attempting to corral emerging monetization options back within its creaking 70:30% walled garden.

Of course, none of this should be a surprise. Under the guise of data privacy, Apple effectively destroyed the entire +$50 billion UA ecosystem with its opt-in ATT changes in 2021, screwing over Facebook and every F2P game developer in the process.

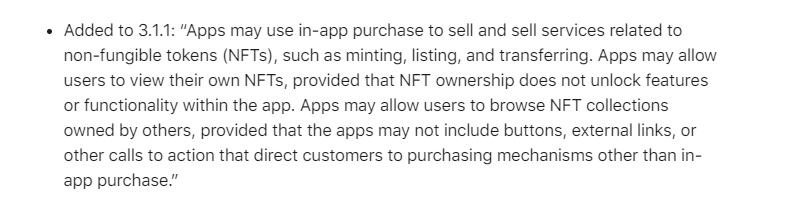

And this is the context for understanding why Apple has formalized the status of NFTs: apps can now officially mint and enable the trading of NFTs as long as they use the App Store’s IAP payment system.

The reason? As Tim Sweeney puts it “Apple’s only motivation is money”.

Obviously for anyone wanting to take Apple up on its offer, the problem is that Apple takes 30% of all transactions, which is — perhaps — doable in terms of a primary sale, but a 30% margin on each ongoing NFT trade is clearly prohibitive.

Trading would also be restricted to using the App Store’s predefined price points.

But what’s more significant is that Apple doesn’t allow externally minted — nor it seems even App Store-minted — NFTs to have any special features because NFT ownership can’t be used to “unlock features or functionality”.

Apple’s view of NFTs appears to be that they are purely aesthetic digital assets without any utility other than that Apple can tax their financial movement.

Retrospective banhammer

This lack of utility clause will be a problem for existing live apps on the App Store, which provide an entry-level experience for non-NFT holders, with crypto features such as earning tokens unlocked through NFT ownership.

However, this is not the only option for NFT games. For example, Wildlife Studios’ Castle Crush only has one basic PVP mode, which can be played using standard cards or with NFT versions of those cards, which don’t unlock additional in-game functionality but are more powerful, enabling faster progression.

That stated, using these NFTs does enable players to collect the game’s ASC token in an external Metamask wallet and the ability to rent NFTs from other players though thirdparty platforms.

Whether this counts as “functionality” remains to be seen but the assumption is likely, yes it is.

Even aside from NFTs, Apple has also affirmed that “Apps may not use their own mechanisms [i.e. in/direct payment methods] to unlock content or functionality, such as license keys, augmented reality markers, QR codes, cryptocurrencies and cryptocurrency wallets, etc.”

Other App Store-available Web3 games likely to be impacted by these changes are Splinterlands — which I note has already removed the ability to buy its non-crypto Credits in-app — and Skyweaver, which currently has a full wallet integration using USDC to purchase in-game NFTs.

Both games will have to be extensively re-engineered to fulfil these new guidelines.

So, even with Epic’s lawsuit still rumbling on — the next hearing is Friday 11th November — Apple is increasing its control over what happens within the App Store.

To me — and I understand it seems an extreme comparison but nevertheless — this is an outworking of what’s also happening in Russia and China, politically. The centralization of power acting towards an over-arching vision with no internal channels of constructive criticism does not allow for any policy moderation. Decisions become increasing outrageous and the oil tanker accelerates slowly to its eventual doom on the rocks.

Because over the long term, fundamental change is the only thing that can result from such policies.

Apple and Google’s app store duopoly is already under sustained attack from various national regulators such that neither the App Store or Play Store can truly claim to have global set of rules due to the growing list of country-specific restrictions impacting Apple and Google’s own restrictions.

Even as I write, India’s antitrust watchdog has fined Google $113 million for abusing its dominant position in the Indian market, also ordering it to allow devs to use thirdparty payment systems. Similar judgement have made in Japan and South Korea.

The centre cannot hold

And it’s both at this macro global app store level and the micro level of NFTs that change has to come, which has to be encouraging when it comes to new business opportunities for content distribution.

In that context, Solana’s full-stack Web3 phone can’t come out soon enough. I’d also be surprised if new phone OEMs such as Nothing don’t make moves in this direction. It’s already experimented with NFTs.

Niche luxury outfit Vertu has just announced its Metavertu Android device, which runs a light Ethereum node and allows you to mint NFTs from photographs. I don’t know if there’s an app store yet and prices start from $3,600. Evens so, I’m tempted.

Then there’s the question of how existing OEMs, notably Samsung — which has been on-off concerning NFTs and web3 via its own Galaxy app store — deal with the situation.

As the App Store becomes an effectively NFT-free zone but Google keeps the Play Store relatively open, it’s not ridiculous to think there could be a million or so customers looking to transition and acquire a Samsung Galaxy S or Google Pixel device.

This will put pressure on the Android ecosystem to become more Web3-friendly. It’s worth noting that parts of Google are already very engaged with blockchain, with Google Cloud via its new Digital Assets Team acting as an official validator for multiple blockchains including Ronin and Flow.

But in the short-term, Apple’s restrictions will see Web3 game developers struggling to switch their focus from being mobile-first to web, with all its diverse issues, perhaps also with an attempt to push sideloading as a strong secondary distribution channel for emerging markets and/or crypto-savvy western gamers.

That’s not ideal, for no matter where Google’s attitude ends up, feature fragmentation between the two app stores can only impact the ability of these games to scale virally on a global basis.

There’s also the bitter irony in that simultaneous with these discussions, Steam has hit an all-time high in concurrent PC gamers — 300 million.

Its decision to ban games using NFTs is another reminder that native Web3 distribution for all types of games remains a massive opportunity for someone to build out.

We’ll have to see if one or more of Ultra, Flame, Robot Cache, Hashup, The Abyss etc can take advantage of the situation. Certainly, there’ll never be a better time to make an impact.

Jon’s Gamestx Substack is home to his on-going thoughts on the collision of gaming and player-owned value networks and is sponsored by HiroCapital.

Sign up for the free weekly newsletter for a big slice of all the key trends happening in this dynamic sector, and for a daily dose and full access to the archive, sign up for the paid option.