New Q1 2024 industry report shows strong sector growth with Pixels and Ronin on top

As the first quarter of 2024 is done, the Big Blockchain Game List has compiled its first quarterly report looking at key trends in the blockchain gaming industry.

What just happened?

With the price of ETH rising 52% during Q1 2024 and BTC up 65% – also hitting an all-time high of $73,738 on 14th March on the back of $12 billion of inflows from institutional and retail investors in the form of the Bitcoin ETFs – it’s clear the crypto market is in full bull territory.

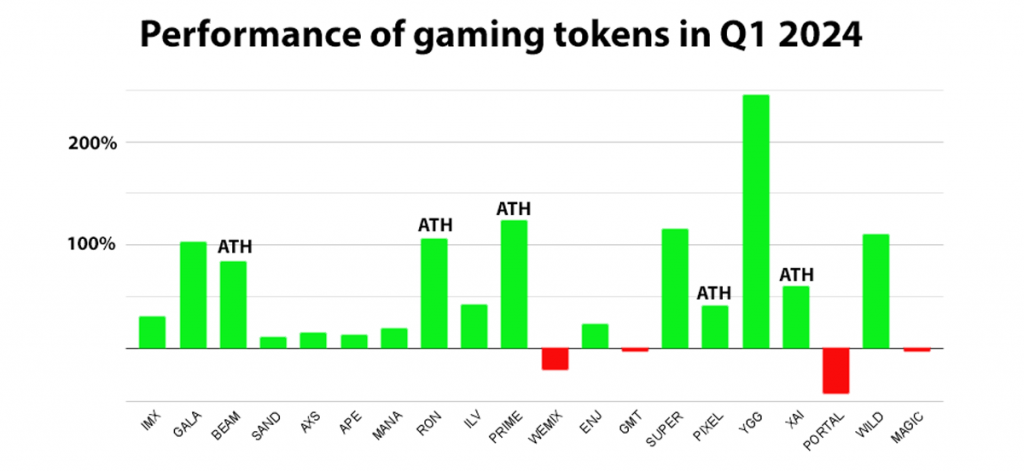

The situation for the blockchain gaming sector proved more nuanced however, with strong sentiment in January and February driven by token launches such as Heroes of Mavia‘s MAVIA and many play-to-airdrop events – notably for Pixels’ PIXEL token – lessening in March as wider crypto interest cycled into more speculative assets, notably Solana-based memecoins.

This isn’t to say game companies haven’t tried to ape into such sentiment. After prolonged social media shilling, the launch of so-called “universal gaming coin” PORTAL in late February was one such. The weakness of gaming in such a category is that the temptation to invoke utility becomes irresistible. But what’s a memecoin with a roadmap?

Thankfully, actual utility was the focus for some gaming projects during the quarter, with the most successful crypto-native investments involving the launch of scaling infrastructure and associated node sales. Examples include Xai’s Arbitrum-based L3, which raised $15 million in node sales (in December 2023), and Hytopia’s Arbitrum-based Hychain, raising $8 million. Gaming adjacent cloud-compute project Aethir raised over $65 million from its node sale.

Other projects talking up their efforts to launch similar tech include Proof of Play (Pirate Nation), TreasureDAO, Xterio and Wilder World. Brutally put, it’s now so simple to launch your own blockchain, most projects are at least considering it. Whether they need to do so is considered irrelevant given the opportunity to raise funds.

Notably, at this point it’s worth highlighting the power of a growing band of individual angel investors – we could impolitely label them the degen mafia – who are levering their social media muscle to highlight earning opportunities to their followers, often also maximizing their own ROI via valuable referral programs, which can deliver six figure rewards.

Obvious winners

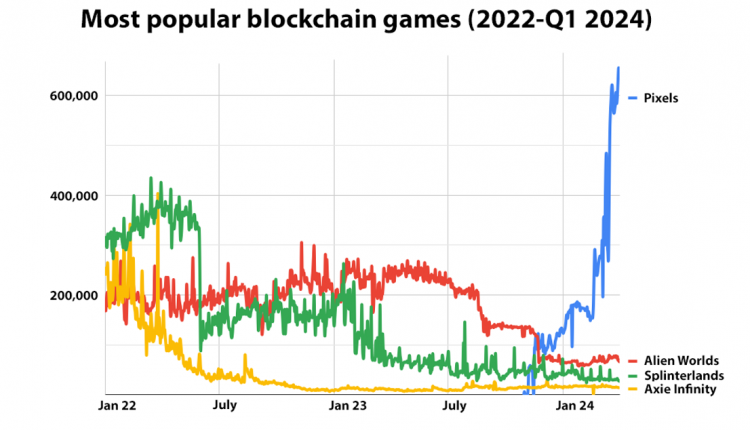

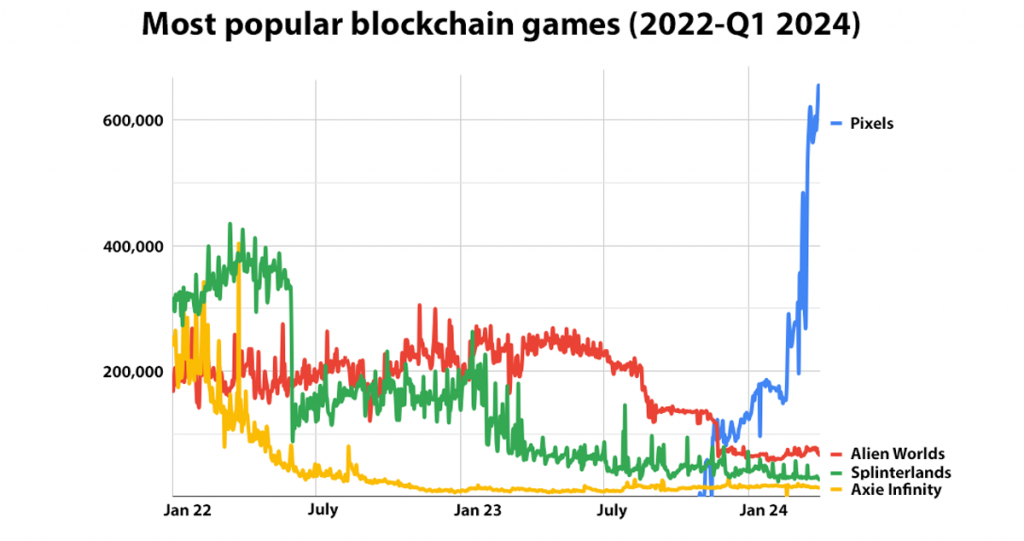

Aside from such considerations, however, there were teams demonstrating product-market-fit, with the quarter’s obvious winners being Sky Mavis’ Ronin blockchain and social RPG Pixels, which in becoming the most popular blockchain game, also propelled Ronin to an all-time high of 1.2 million daily active unique wallets.

On the back of this activity, other Ronin-based projects such as Apeiron, CyberKongz and Kaidro experienced a halo effect, notably in terms of their tokens’ value and NFT launches, although they are still early in their journey. Even veteran Yield Guild Gaming’s YGG token got a healthy boost from launching on Ronin.

The situation for other playable blockchain games was more complex, notably because while they are playable, their blockchain features are generally lightweight. Nevertheless, headline news from team shooter Nyan Heroes and strategy game Blocklords was they had each achieved over 100,000 downloads from the Epic Games Store, while extraction shooter Shrapnel has seen over 60,000 players across its two playtests.

More significant, perhaps, have been the claims Big Time has made $100 million in revenue since starting its pre-season event in October 2023 from a combination of NFT and premium currency sales plus secondary sales and rentals fees. In addition, Pixels‘ current monthly recurring revenue for its VIP program is running at $1.6 million. These are the first examples of blockchain games generating sustainable, not speculative, income.

For, it will be those projects that can combine playerbase and revenue with an overall vision and the delivery of new features, while wrangling the currents of crypto sentiment and the peculiarities of their own communities, that will be best placed for long term success.

Big Blockchain Game Report – Q1 2024

In addition, the report dives into all the key trends revolving around

- Token performance – including new and existing tokens

- Onchain gaming activity – most popular games?

- Investment into the web3 gaming sector – most active investors?

- Broader ecosystem movement – which chains gained most new games, and which saw the biggest decrease?

You can read the full Big Blockchain Game Report Q1 2024 here, and/or download a pdf version here.

Comments are closed.