Raising pain continues for blockchain games

BlockchainGamer.biz editor-at-large Jon Jordan has been writing about the games industry since 1999. He predicts blockchain is the next great disruption and in our weekly column he shares his views on everything web3 games. You can read more in his Substack and contact him via [email protected].

A year ago I spent a lot of time trying to track all the investments into the blockchain game sector.

And, actually, I’m still doing so only now it requires nothing like the same overhead as activity continues to drop as the figures below demonstrate.

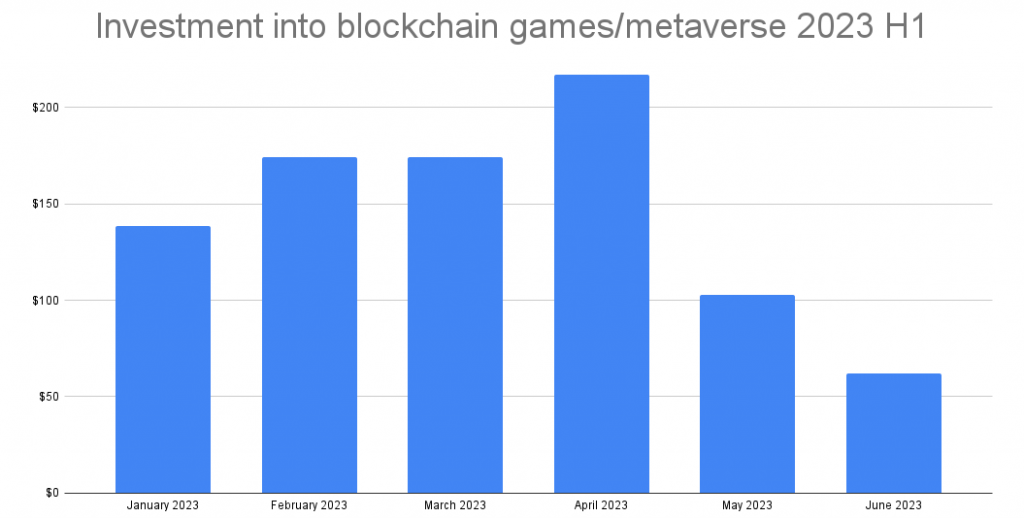

- Total investments during H1 2023: $889 million

- Total investments in 2022: $8.2 billion

- Total investments in 2021: $4.3 billion

- Total investments in 2020: $88 million

Depending on your point of view, you could highlight the almost 1000% increase from 2020 to H1 2023 as a positive or the -90% decrease from 2022 to H1 2023 (technically down 85% year-on-year) as the disaster. Take your pick.

I think a lack of resources is probably what many companies in this sector require in order to think very carefully about burnrate, runway and generating revenue.

Taking everything crypto and macro into account, the truth is we’ve probably passed through the nadir.

In June I measured just $60 million of investment, which hopefully means VCs are now investing smaller amounts into better quality projects at sensible valuations.

That’s the foundation on which long-term success is eventually built.

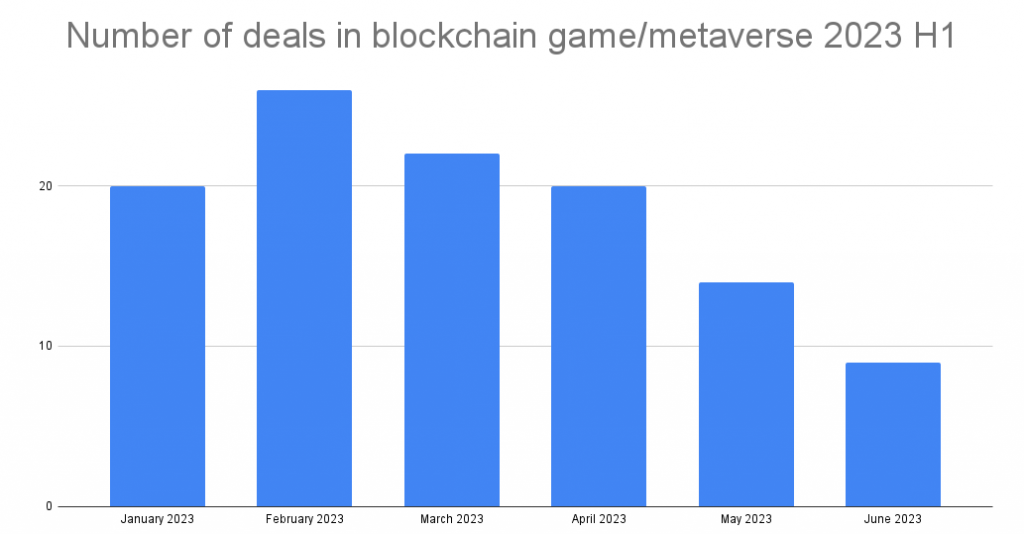

But given that provision, it’s clear to see from the number of deals just how unfashionable blockchain game and metaverse projects now are compared to you know what…

Still — ever the optimist — I think a lack of resources is probably what many companies in this sector require in order to think very carefully about burnrate, runway and generating revenue.

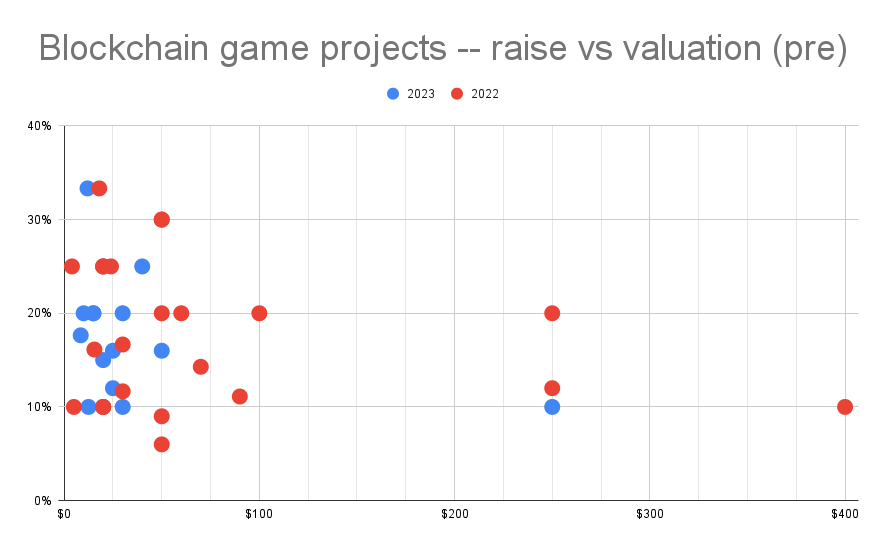

Raising a lot of money on a massive valuation now seems antithetical to finding success in a sector which is clearly much more complex from both a product and a go-to-market point of view than the traditional game space.

And this is being reflected in both valuations and how much money companies say they want to raise. In the graph below the red dots are generally higher up and more to the right. Market conditions have sucked them back to sanity (0,0).

Of course, in the long run, this means successful blockchain games will be even more valuable, both to their founders, shareholders and investors. We’ll also likely see some large Series B and C rounds for those games demonstrating some level of product-market-fit during H2 2024.

But in the short term, I think its current lack means there’s a logical argument that company’s early stage valuations should be compressed relative to their non-blockchain peers.

More hard tacks today before the promise of jam tomorrow.

Don’t miss out on any daily news from the blockchain games space: sign up to our Substack, follow us on Twitter and connect with us on Linkedin.